Retirement Planner

Retirement Planner의 설명

Retirement Planner helps you determine how much money you will need for your retirement to maintain the current lifestyle post retirement. You can give the Current Age, Retirement Age, Current Monthly Expenses, Expected Inflation, rate of returns on your investments before retirement and rate of returns on your investments after retirement.

Features

- Fields for Current Age, Retirement Age, Life Expectancy, Monthly Expenses, Inflation, Rate of Return on investment Before Retirement & After Retirement, Years to Retire, Yearly Expenses at retirement, Retirement Corpus, Monthly Investment

- Settings for Default Values - Currency Symbol, Rate of Return, Inflation, Retirement Age, Monthly Expenses & Reload Last Values

- Chart showing Monthly Investment, Yearly Retirement Income and Balance at End of every year in Retirement Corpus.

- Chart Save Chart Menu to save chart file in SD Card folder which user can attach in email.

- Hindi and Korean language added

- Existing Investment field added

- Lump sum investment required

- Monthly investment required

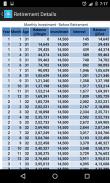

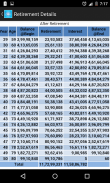

- Retirement Details Table with Investment required before retirement and Inflation adjusted Retirement Income after retirement.

- 2 new premium features added - Save as PDF and Email with PDF

- In app purchase for 1) App upgrade to Premium and 2) Remove ads

- Sample PDF file available at http://www.financialcalculatorsapp.com/Files/RetirementPlanner_sample.pdf

- Number formatting is now based on device locale

Age (Years) : 30

Retirement Age (Years) : 58

Monthly Expenses : 30,000

Inflation (%) : 7

Rate of Return (%) on investment Before Retirement : 15

Rate of Return (%) on investment After Retirement : 10

Year to Retire : 28

Monthly Expenses at retirement : 199,465

Yearly Expenses at retirement : 2,393,582

Retirement Corpus : 39,998,159

Monthly Investment : 7,719

Example:

Suppose you are 30 years old who wants to retire at 58 and expect to live till 80.

If your current Monthly Household Expenses (excluding expenses which will not be part of it post Retirement e.g. EMI, Insurance Premium, Education Expenses etc) are 30,000,

You expect inflation to be around 7% for next 28 years,

You expect 15% return on your investments before retirement and

During retirement you expect that your investments will return 10%.

So Number of Years left for your retirement are 28 years and at retirement you will require a retirement corpus of 39,998,159 for which I need to save 7,719 per month.

Support

Please send your suggestion and issues to my E-mail address nilesh.harde@gmail.com